Planning to Pay for College? Check Out a 529 College Savings Plan

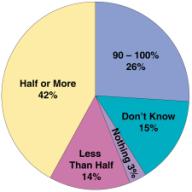

A study commissioned by Strong Capital Management finds that 68 percent of parents anticipate paying at least half of their children’s higher education expenses, and more than one-quarter of these parents foresee footing the whole bill.

Moreover, the study, conducted by TeleNation, found parents expect the total tab for higher education to cost between $50,000 and $100,000 for each child.

Parents’ anticipated contributions to child’s higher education costs.

Parents’ anticipated contributions to child’s higher education costs.

“Parents plan to contribute substantial amounts towards their children’s education, even in light of escalating costs,” said Sarah Henriksen, Strong’s Manager of College Savings Plans, adding that college and related expenses for both private and public universities are rising at annual rates of above 7 percent. “Those who start early, save often, and take advantage of the power of compounding will be better prepared when it comes time to write the check.”

The national telephone survey of 368 parents of college-bound children under 18 found that nearly one-quarter of parents are unaware of one of the best college savings vehicles available — state-sponsored 529 college savings plans, also called Qualified State Tuition Plans. Increasing in popularity, 529 plans operate somewhat like 401(k) retirement savings plans, offering competitive stock and bond market investment options that grow money tax-deferred specifically for higher education expenses.

Strong Capital Management manages two 529 college savings plans: the nationally available EdVest College Savings Program, sponsored by the state of Wisconsin; and the Oregon College Savings Plan, which will open to non-residents in Fall 2001.

“529 college savings plans are the best thing the government has done to encourage saving since the IRA,” said Henriksen. “These programs offer high contribution limits, varied and competitive market-based investments, and significant estate-planning benefits. Savings grow tax-deferred, and upon withdrawal, the distributions are taxed at the child’s rate, which is typically much lower than the contributor’s rate.”

All 50 states now either have a 529 plan, or have approved 529 plan legislation. State-sponsored plans differ with respect to required fees, minimum and maximum contributions, state tax benefits, and other important considerations.

Information about 529 plans is available from Strong’s College Planning Specialists at 800-368-8040, a toll-free line answered 24 hours a day, 7 days a week. Information can also be accessed at Strong’s interactive web site (http://www.Strong.com), http://www.EdVestOnline.com, or http://www.OregonCollegeSavings.com

One of the nation’s leading investment management firms, Strong Capital Management is a privately held, registered investment advisor serving individuals, retirement plans, financial advisors, institutions, and foundations. Securities are distributed by Strong Investments, Inc., an affiliated company. Founded in 1974, the firm is headquartered in Menomonee Falls, Wis., and manages over $42 billion.

Strong Capital Management, Inc. administers and manages two 529 college savings plans: EdVest, a program sponsored by the state of Wisconsin and available nationally, and the Oregon College Savings Plan, to be offered nationally in fall of 2001.